eCommerce Compliance Checklist For Your Online Store: Everything You Need

Summary

From business registration to meeting global data protection laws like GDPR and CCPA, this guide walks you through all the essential legal and operational requirements you need to know.

Not sure if your online store meets all the legal requirements?

Running an eCommerce business comes with a unique set of legal responsibilities — ones that go far beyond those of a physical store. From privacy policies to payment compliance, there’s a lot to consider.

That’s why we’ve created the Ultimate eCommerce Compliance Checklist, a simple, actionable guide to help ensure your online store meets every essential legal regulation.

Ready to check off all the must-have compliance items for your store? Let’s dive in.

- Essential eCommerce Compliance Checklist

- 1. Register Your Business

- 2. Obtain an EIN

- 3. Business Licenses & Permits

- 4. Privacy Policy (CCPA/GDPR if applicable)

- 5. Terms & Conditions

- 6. Return & Refund Policy

- 7. Shipping Policy

- 8. Disclaimers (Product/Medical/Results-based products)

- 9. Sales Tax Collection

- 10. File Regular Sales Tax Returns

- 11. Marketplace Facilitator Rules

- 12. PCI-DSS Compliance

- 13. SSL Certificate (HTTPS)

- 14. Data Breach Protocol

- 15. FTC Compliance

- 16. ADA Website Accessibility

- 17. Age Restrictions (COPPA Compliance)

- 18. CAN-SPAM Act Compliance

- 19. SMS Marketing Compliance (TCPA)

- 20. Affiliate Disclosure Compliance

- 21. Business Insurance

- 22. Copyright & Trademark Protection

- 23. Recordkeeping

- Fines & Penalties for Non-Compliance with Global Laws

- How WPLP Compliance Platform can make your eCommerce website compliant

- Download the eCommerce Compliance Checklist by WPLP Compliance Platform

- FAQ

- Conclusion

Essential eCommerce Compliance Checklist

1. Register Your Business

It is mandatory to register your business for legal compliance, as website legal requirements must be followed.

- Firstly, you will need to decide on the legal framework of your business. For example, sole proprietorship, partnership, LLC, and corporation.

- Secondly, make sure you have all the authorizations like sales tax permission, Etsy business license, and more.

- Thirdly, your business location needs to follow the local zoning regulations.

- Lastly, protect your business name by registering it with your local body so that no other business can use it.

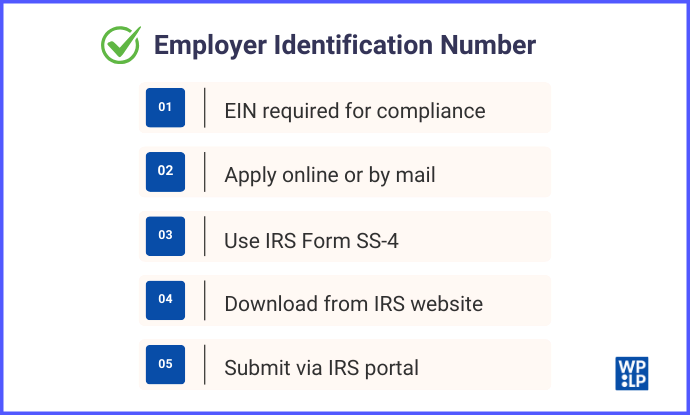

2. Obtain an EIN

Employer Identification Number (EIN) is mandatory for compliance in eCommerce in the United States.

In order to get the EIN, you need to submit an online form or mail an application form (Form SS-4) to the address on the form.

The application form will be available on the official IRS website. The EIN application form can be downloaded or filled out on the IRS Portal.

3. Business Licenses & Permits

In the United States, the licenses or permits for an online store differ in every state.

You will need to consult with your municipality to obtain the permits required locally for your online business.

Moreover, you will require a general business license for operating in the state.

For a reselling online business, you will need a reseller’s permit. For a home-based online business, you will need a home occupation permit.

Consulting your local legal bodies is the most crucial step to get the permits according to the state you are currently working in.

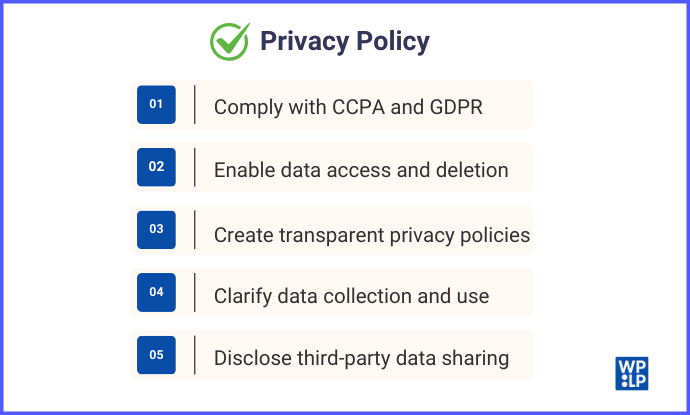

4. Privacy Policy (CCPA/GDPR if applicable)

Compliance with eCommerce regulations like the California Consumer Privacy Act (CCPA) and the General Data Protection Regulation (GDPR) is a must.

CCPA allows users to access, delete, and revoke permissions, while GDPR helps users to correct, delete, or request a copy of their personal data.

Businesses should create privacy policies that abide by these regulations. It should clearly mention data collection and retention policies with prior consent.

The privacy policy will have to define the types of personal data collected and the purpose of its collection. You should also clarify the data processing of the collection of user data.

Users should be informed how their data will be retained and how they can actually delete it by requesting.

Data sharing with third-party vendors or service providers should also be clearly outlined. While doing so, you need to ensure that these third parties are abiding by the data regulations and are actually using the information for the specified purpose.

5. Terms & Conditions

eCommerce businesses need to formulate various policies, including terms of service, privacy policies, and return/refund policies, which are easy to understand. Your Terms of Use should include:

- Website boundaries should clearly be defined, such as that hateful or vulgar content is forbidden on the website.

- In order to protect your business, use disclaimers like no liability is on the business’s end for indirect damages.

- Avoid violations by checking that your T&C follows local and state laws. Also, check if your T&C policy follows federal laws like consumer protection laws, advertisement regulations, and relevant laws according to your industry or products.

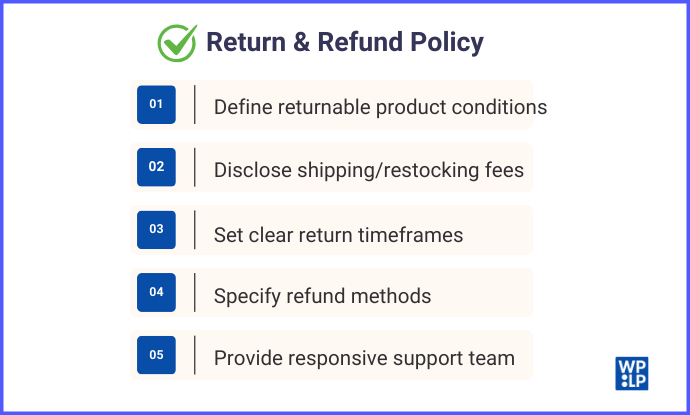

6. Return & Refund Policy

eCommerce businesses should have operational transparency in their return and refund policies according to the Federal Trade Commission (FTC).

A well-documented and communicated policy eliminates legal liability and provides assurance to users. So here is your eCommerce compliance checklist for the same

- Specify the returnable products and their conditions for return. For example, the product must be unused, or the products need to be returned within 30 days.

- Clearly communicate if a return shipping fee or a restocking fee is applicable.

- According to the type of your products, set a realistic timeframe for the return window; 15 to 30 days is generally the norm.

- Mention the return of payment specifically, like through bank, card, or store credits.

- Make sure that certain types of products have different return policies, like perishable products and electronic products.

- Have a good team of customer support who will calmly cater to the grievances of the returned goods by the users.

Check out our WPLP Platform Compliance tool – Return and Refund Policy generators

7. Shipping Policy

A shipping policy is a significant part of the eCommerce compliance checklist as it is a crucial bridge between your business and your customers.

The information in your shipping policy should be unambiguous, and there should not be any room for misinterpretations.

- The total amount should be shown, which includes the shipping fees.

- Provide an accurate and true delivery time estimate. Openly state the regions or areas where delivery is not provided.

- Don’t include any hidden fees like border taxes or taxes on goods sent abroad. Mention it transparently in the fee.

- Use trusted and reputable payment gateways to avoid unsafe transactions

8. Disclaimers (Product/Medical/Results-based products)

In order to protect your business and your customers, your eCommerce store should have a clear disclaimer.

- Customers cannot be misinformed about the shipping fees, delivery date, or pricing of the goods. You should always display a transparent privacy policy in the simplest language possible.

- Methodically explain the return policy to the customers and the step-by-step procedure.

- Inform the customers about the cancellation deadlines by which the orders in transit can be stopped. There are provisions in the EU, like the 14-day cancellation duration.

- Adherence to laws like the GDPR. Data Protection laws and the Consumer Protection Act are compulsory.

- Place disclaimers in strategic areas like product pages, terms, and conditions for customers to view.

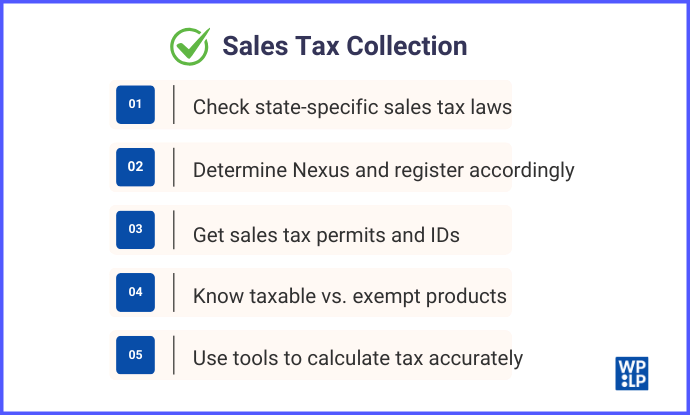

9. Sales Tax Collection

Adhering to eCommerce laws in the United States can be confusing since the laws differ in every state. Hence, sales tax should be regularly checked to see if they are aligned with the regional or local laws.

- If you have a physical entity like a warehouse or office, or if your sales are crossing a specific threshold, you might need to be collecting sales tax, which is the Nexus in the State.

- Nexus laws differ in each state, and you will need to research and understand the nexus of your particular state.

- You need to register for a sales tax permit with the state tax authority if you have a Nexus in the state.

- Additional Tax IDs will be required for the type of your business, such as sole proprietorship, LLC, and more.

- Understand which of your products apply to sales tax and which are exempt.

- Calculate sales tax carefully, as it varies between jurisdictions.

- Make sure that your eCommerce website has functionality or tools like Avalara or TaxJar to calculate the sales tax and display it before the checkout process.

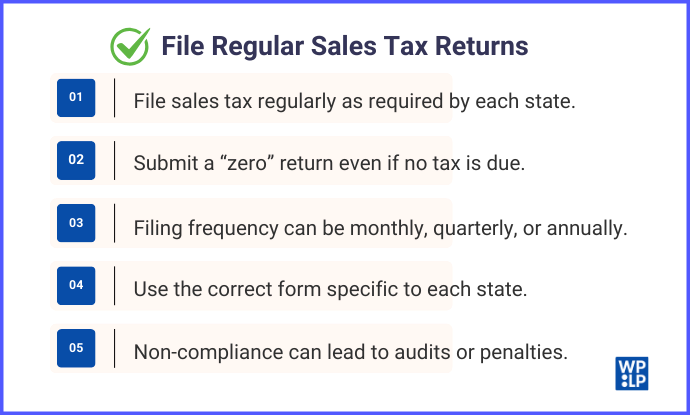

10. File Regular Sales Tax Returns

You need to file for sales tax regularly, even if there is no sales tax due.

According to your sales, the States have made it compulsory to file tax annually, quarterly, or monthly. If you have no tax due, then file a “zero” return to comply with the state tax authority.

Each state has different sales tax forms; make sure you are choosing the right one. Non-compliance can lead to penalties or audits.

11. Marketplace Facilitator Rules

If you are selling your products on platforms like Amazon or Etsy, you don’t need to collect tax yourself. Marketplace facilitators will collect tax for you.

Make sure you read the polices on how marketplaces collect tax on your behalf, because that depends on that platform’s policy and the state itself.

You may still have to file the sales tax even if the marketplace collects it, according to your respective state’s rules. It will also help keep track of the total sales.

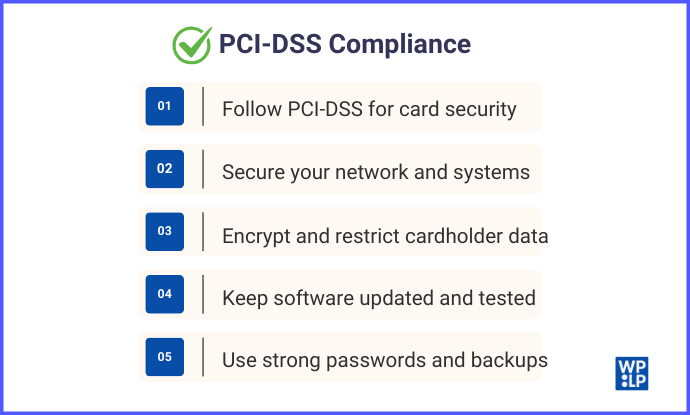

12. PCI-DSS Compliance

Payment Card Industry Data Security Standard (PCI-DSS) is a collection of security regulations that protects cardholder information during transactions.

All businesses that accept, process, store, or transmit credit card data need to adhere to the PCI-DSS. It ensures that all the financial transactions are happening in a secure environment and there is no fraud.

You need to ensure that your network security has installed firewalls, uses intrusion detection systems, has antivirus software, and keeps systems configured safely.

For cardholder data protection, you need to encrypt cardholder data, assign a unique ID to the personnel, and restrict physical access to the cardholder data.

Do vulnerability management by keeping software up to date and simulating attacks to understand pain points.

Other things that you can do to protect your user’s financial data are to have strong password policies, regularly back up data, and review and update compliance measures constantly.

13. SSL Certificate (HTTPS)

An SSL certificate encrypts your customer’s data, boosting site credibility and also protecting your user’s sensitive information.

You can get an SSL/TLS certificate from a dependable, certified authority (CA). Let’s Encrypt (free) and other pro services like DigiCert or Comodo are some good options to obtain an SSL certificate.

Once you get the certificate, you will need to configure your web servers and update your website to enable HTTPS.

Then you will have to redirect HTTP URLs to HTTPS, so that your users arrive on a more secure website and you won’t come across the issue of mixed content.

To test the security of your website, you can use tools like SSL Lab’s SSL Test. It will also check the validity of your SSL/TLS certificate.

14. Data Breach Protocol

However secure your website is, it’s never 100% bulletproof. So, it’s highly important to have a data breach protocol.

- Have a good, experienced response team ready from all departments, IT, legal, PR, and customer service teams.

- Identify the source of the problem to stop it from spreading further

- Understand the level of threat and the potential risk to the customer.

- You will have a specific timeframe to communicate and notify affected groups and make them understand the next steps.

- If required by the state, report the data breach to the data protection authorities or regulatory bodies.

- After handling the data breach, conduct an audit to ensure that the website is completely safe and take measures accordingly to prevent similar future incidents.

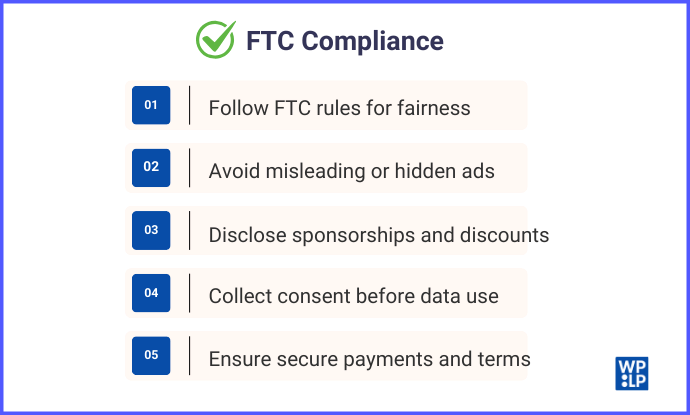

15. FTC Compliance

The Federal Trade Commission (FTC) protects consumers from malpractices and saves business owners from legal liabilities.

You are legally obliged to follow the FTC guidelines in the USA to ensure transparency, fairness, and trust with your consumers. Here’s how to align your e-commerce store with FTC requirements:

- Don’t put deceptive advertisements for your products.

- Specifically mention to your audience if it’s a sponsored advertisement.

- Anything related to a discount should be displayed clearly on the screen of the ad.

- Make sure you are collecting consent before collecting user information, and mention how you will share and use your consumer data.

- Give proper terms of service like order fulfillment, cancellations, and dispute resolution.

- Use a secure, PCI-DSS certified payment gateway and encrypt sensitive data.

Check out our WPLP Platform Compliance tool – FTC Disclosure Statement Generator

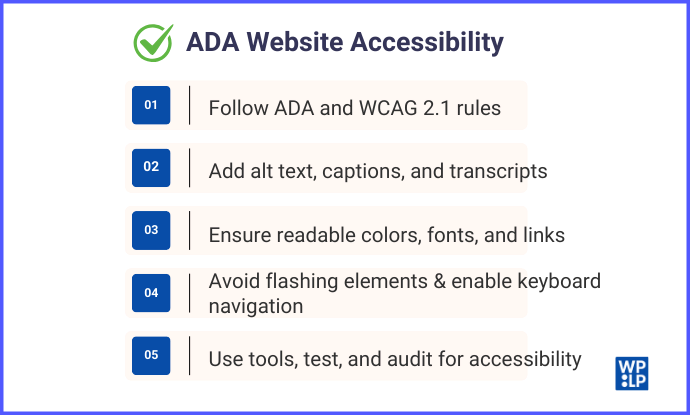

16. ADA Website Accessibility

Americans with Disabilities Act (ADA) and WCAG 2.1 AA are laws made for people with disabilities to access any eCommerce website. Every eCommerce site needs to comply with these laws in order to avoid legal risks and penalties.

- Alt text – Make sure you have added appropriate text to all the images, especially product images, on your website.

- Captions and transcripts – You need to provide video captions and transcripts.

- Color contrast and fonts – You need to use readable contrasting colours and provide a text resizing option wherein resizing can be done up to 200% without loss of readability.

- Links – Provide clear anchor text for your links. Generic anchor texts like “Click here” should be avoided.

- Repeating Flashing Elements – Don’t use any strobing or flashy visuals to avoid seizures.

- Keyboard Navigation – Consumers should be able to navigate through the website without using the mouse.

- Consistent interfaces – Be consistent with your page design across the website, including proper headings and semantic HTML.

- Tools – You can use assistive technologies like WAVE or Axe to check issues.

- User Testing – Conduct performance tests on users who need assistive technologies for more input.

- Accessibility Audits – Regularly perform accessibility audits to fix accessibility issues.

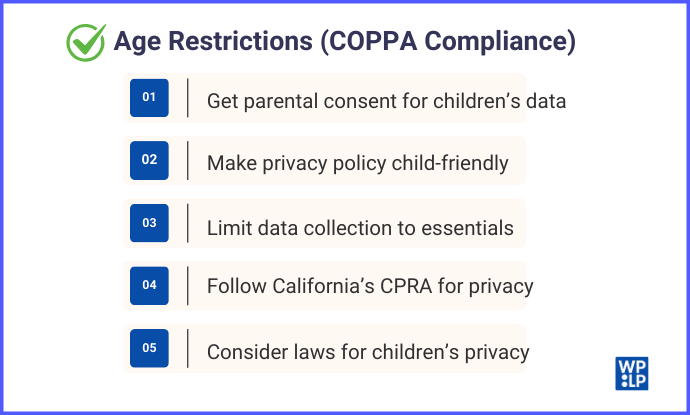

17. Age Restrictions (COPPA Compliance)

The Children’s Online Privacy Protection Act (COPPA) is applicable when your eCommerce website collects data from children younger than 13 years of age.

You need to get parental consent before obtaining any personal information. Your privacy policy should be explained clearly for a child to understand.

Only gather necessary data and limit data collection. Do not ask for irrelevant information.

Overlapping laws like California’s CPRA, which provide privacy rights to children between the ages of 13 to 15 should be taken into consideration.

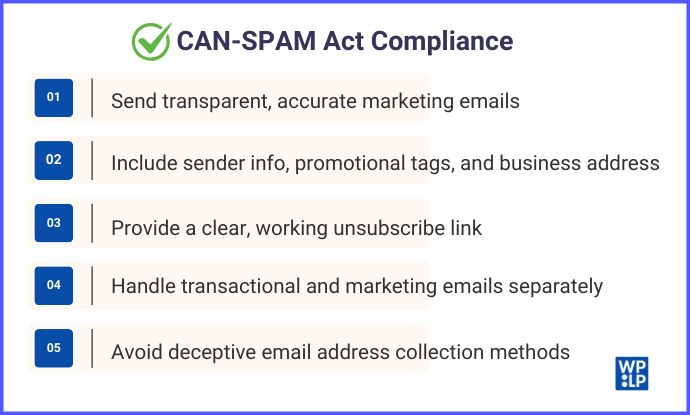

18. CAN-SPAM Act Compliance

To abide by CAN-SPAM Act regulations, you need to make sure that your eCommerce website handlers are sending correct and transparent marketing emails according to the user’s preference.

- Provide all the accurate information needed, like the domain or the sender’s name.

- Indicate promotional or marketing messages.

- Include the postal address of the business in the email.

- The unsubscribe link should be easily clickable and should work for at least 30 days. All opt-out requests should be made within 10 days.

- Segregate transactional emails from marketing emails, since only the latter requires compliance with CAN-SPAM.

- Lastly, do not use deceptive methods to obtain email addresses.

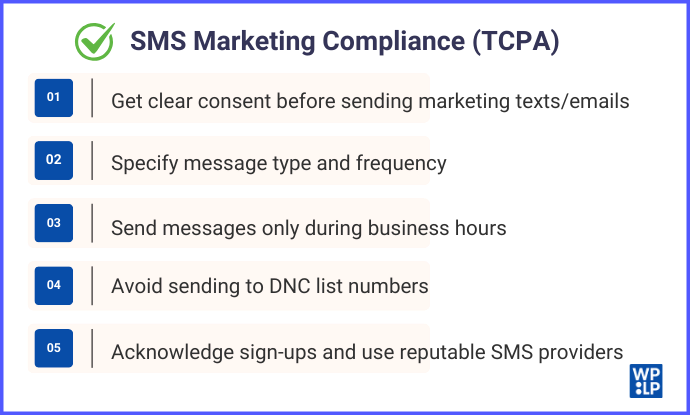

19. SMS Marketing Compliance (TCPA)

To comply with the Telephone Consumer Protection Act (TCPA), your eCommerce website should put clear consent in place before sending marketing texts, emails, and also offer opt-out options.

You need to explain the message type and how many times consented users might receive the emails or texts. Messages should be sent only during business hours and never to numbers on the DNC (Do Not Call) list.

You need to send acknowledgement emails to users who sign up and depend on reputable SMS service providers to avoid legal trouble.

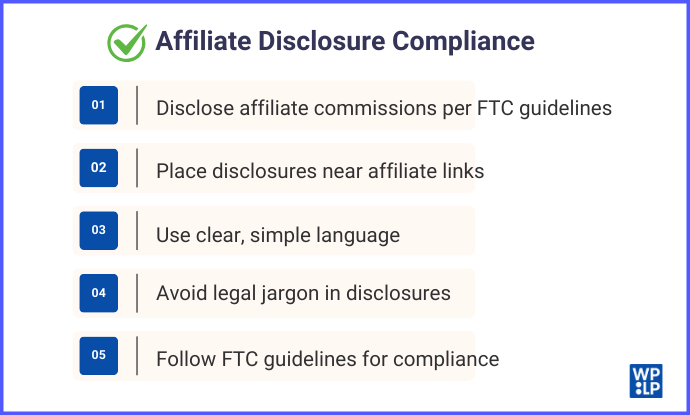

20. Affiliate Disclosure Compliance

Affiliate disclosure is a must according to the FTC guidelines.

- Disclose where your eCommerce website can earn a commission.

- You need to put disclosures near the affiliate links on the website.

- Use simple and clear language to avoid legal jargon.

- Abide by the FTC guidelines.

21. Business Insurance

Insurance coverage is extremely important to protect your business.

With insurance, you can make sure that your business is safeguarded from liabilities.

It can cover you against:

- Property damages

- Third-party injuries

- Data breaches

- Online hackers

- Online fraud

Adjust these optional policies to an annual calendar, or at a minimum, once a year, to make sure coverage is consistent with designated downtimes to avoid any damage to your business.

22. Copyright & Trademark Protection

To protect your eCommerce website content, your intellectual property (IP) policies should be trademarked or copyrighted.

Register for trademarks so that your business name, logo, domain, and other distinctive identifiers are not stolen.

Protect contents such as product photos, website copy, and design by copyrighting them, and obtain rights for all third-party materials on your website to prevent any legal disputes.

23. Recordkeeping

Lastly, on our eCommerce Compliance Checklist is recordkeeping. Proper recordkeeping is crucial for any business. It helps mitigate risks and conduct a more accurate audit.

All the departments, like finance, marketing, shipping, logistics, and legal, should have all the records of their business activities.

This will make compliance easier, support in dispute cases, improve customer service, and identify risks.

A strong recordkeeping system helps eCommerce businesses remain compliant, secure, and efficient.

Fines & Penalties for Non-Compliance with Global Laws

Not adhering to the eCommerce regulation may cause:

- Legal fees and court action for breach of data protection or consumer policies, like GDPR fines, which can be huge.

- Losing reputation, monetary loyalty, or sales results due to the reputation loss.

- Site outages, expensive remedial work, and increased attention from regulators can cause operational disruptions.

- Frozen payment gateways can halt sales activities.

Compliance is extremely important to avoid risk and ensure good business operations.

How WPLP Compliance Platform can make your eCommerce website compliant

Once you’ve identified what’s required, WP Legal Pages makes policy creation simple.

With WP Legal Pages, you get:

- 35+ ready-to-use legal templates

- Compliance with GDPR, CCPA, CalOPPA, and other global privacy laws

- Auto-generated Privacy Policy, Terms & Conditions, Cookie Policy, and more

- Shortcode support, multi-page policies, and auto-updates for ongoing compliance

No need to write from scratch or hire a lawyer, WP Legal Pages gets your policies live in minutes.

Legal pages are only part of the equation. Your site also needs proper cookie consent management, and that’s where the WPLP Compliance Platform comes in.

Key features of WPLP Compliance Platform:

- Google-certified for Consent Mode v2

- Fully WordPress-native: no third-party SaaS scripts

- Automatically shows cookie banners based on user location

- Supports GDPR, CCPA, LGPD, and other global laws

- Logs and stores user consent for audit readiness

- Customizable banners, branding, and behavior

With WPLP, you get full control over how data is collected and how user consent is handled, all in line with the latest legal standards.

Together, WP Legal Pages + WPLP = Complete eCommerce Compliance.

Download the eCommerce Compliance Checklist by WPLP Compliance Platform

Avoid legal issues with a comprehensive eCommerce Compliance Checklist by WPLP Compliance Platform. From privacy policies to cookie consents, we have over 35+ predefined legal templates that are compliant with basic laws like GDPR and CCPA.

Launching a new store or auditing an existing one, this checklist will guard your business and ensure a good shopping experience for customers. Download now!

FAQ

To comply with GDPR, your data collection should be transparent. Obtain consent before processing the data. Provide encryption for user data. Users should be able to access or delete their data. Notify parties of data breaches within 72 hours and have a clear privacy policy in place.

Non-compliance with GDPR can lead to a fine of up to €20 million or 4% of global annual turnover, which is higher for severe violations. For less serious violations, a fine of €10 million or 2% of the revenue can be imposed.

You can write one manually with legal advice, which can be tedious in the header, footer, or anywhere easily accessible by the users. You can also use tools like WP Legal Pages to avoid legal hassle by just selecting a template that complies with data regulation laws.

Conclusion

eCommerce compliance isn’t just about avoiding legal penalties; it’s about building trust, credibility, and a safe shopping experience for your customers.

Staying aligned with regulations like GDPR, CCPA, and other privacy laws is essential for protecting your business and strengthening your brand reputation.

The comprehensive eCommerce Compliance Checklist is designed to help you meet these key legal requirements with confidence. It covers everything you need to know to keep your store legally sound.

With the WPLP Compliance Platform, this becomes effortless. With 35+ pre-built legal templates that are already aligned with global privacy laws, you can quickly generate and update essential policies like Privacy Policy, Terms & Conditions, and Cookie Policy, all directly within WordPress.

And with a cookie banner, you can get consent from people before collecting their data.

If you like this article, you might also like reading:

- Importance of Privacy Policy & Terms and Conditions for your website

- How To Create a GDPR Compliant Contact Form

- Mastering Internet Privacy Policies

Make your eCommerce website compliant using the WP Legal Pages Compliance Platform.