Must-Know CPA Requirements: A Quick Guide to Colorado’s Privacy Law

Summary

To comply, businesses must update privacy policies, get clear consent for sensitive data, and conduct data assessments. Non-compliance can lead to fines of $2,000–$20,000 per violation. Tools like WP Legal Pages and WP Cookie Consent can help simplify compliance.

Heard about Colorado Privacy Act? Here’s what your business needs to know to comply with the law.

In an era where customer data is both valuable and vulnerable, Colorado has introduced a strong data protection law: the Colorado Privacy Act

After California and Virginia, Colorado became the third US state to enforce strong data privacy legislation.

This comprehensive privacy legislation aims to give residents more control over their personal information while holding businesses accountable for how they collecting, storing, and sharing data.

This guide explains the Colorado Privacy Act, who must comply, what rights consumers have, and the steps your business must take to avoid costly penalties.

Let’s begin with all about the Colorado Privacy Act that you need to know.

What is the Colorado Privacy Act?

The Colorado Privacy Act was created to safeguard the online privacy of Colorado residents by providing them with greater control over how their personal information is treated.

The Colorado Privacy Act is modeled after Virginia’s Consumer Data Protection Act (CDPA), California’s Consumer Privacy Act (CCPA), and California’s Privacy Rights Act (CPRA). The CPA is also influenced by the EU’s General Data Protection Regulation (GDPR), which has stipulations on data processors, such as “mandatory data protection assessments.”

However, the CPA introduces a few key differences

In Virginia and California, nonprofits are exempted from data protection laws, while in Colorado, they are not exempted. In general, the CPA covers all entities (profit and non-profit) that cross thresholds of how much consumer data they handle or own.

However, unlike Virginia’s data protection legislation, the law in Colorado doesn’t demand a revenue threshold. The act in Colorado does not apply to employee or business-to-business (B2B) data.

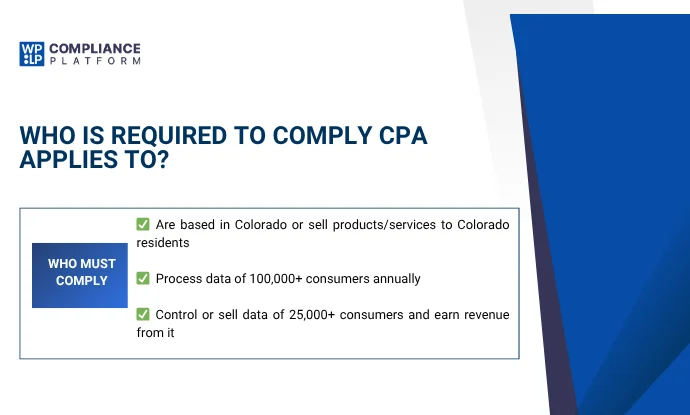

Who Must Comply With the Colorado Privacy Act?

The Colorado Privacy Act (CPA) applies to businesses that operate within the state of Colorado as well as those that target products or services to Colorado residents. Specifically, the CPA covers data controllers that:

- Conduct business in Colorado or produce or deliver commercial products or services intentionally targeted to Colorado residents;

and - Meet one or both of the following thresholds:

- Control or process the personal data of 100,000 or more consumers annually, or

- Derive revenue or receive a discount on goods or services from the sale of personal data and control or process the personal data of 25,000 or more consumers.

In short, if your business meets these conditions, you are required to comply with the CPA, even if your company is not physically located in Colorado.

Compliance can be less difficult for smaller companies since these requirements are nearly the same as they are under the CCPA and Virginia’s CDPA.

Who Is Exempt from the Colorado Privacy Act?

The CPA doesn’t require all businesses to comply. For example, businesses that don’t process data from a sufficient number of residents fall outside the scope of the CPA.

The following entities are also exempt from complying with the CPA:

- Airlines

- Public utilities

- Entities subject to the Health Insurance Portability and Accountability Act (HIPAA)

- Entities subject to the Children’s Online Privacy Protection Act (COPPA)

- Financial institutions regulated by the Gramm-Leach-bliley Act (GLBA)

- Institutions regulated by the Family Educational Rights and Privacy Act (FERPA)

- Institutions regulated by the Fair Credit Reporting Act (FCRA)

- Government agencies in Colorado

- Institutions processing de-identified personal information

- Institutions processing data for employment record purposes

- Institutions processing data for the Colorado health insurance statute

- Institutions of higher education

- Consumer reporting agencies

Compared to other US privacy regulations, CPA does not exempt nonprofit organizations.

What are the Consumer Rights Under the Colorado Privacy Act

Like most modern privacy laws, the CPA provides consumers with certain rights regarding the processing of their personal data.

The rights provided under the Colorado law are identical to those provided by the CCPA and include:

- Right to Access: Consumers under the CPA have the right to know if your business collects or processes their personal data. If so, consumers also have the right to view it.

- Right to Opt Out: Consumers have the right to opt out of processing of their personal data. According to the law, companies are required to implement a universal opt-out system that allows consumers to use their right to opt out through a single button click.

- Right to Correction: Consumers have the right to rectify any old or inaccurate information collected about them.

- Right to Deletion: Consumers have the right under the CPA to request the controller to erase their personal data.

- Right to Data Portability: Consumers also have the right to obtain a copy of their personal data in a readily portable and usable form for transferring to a third party without inconvenience.

- Responding to Consumer Request: According to the CPA, your response timeframe should not exceed 45 days after receiving their request. However, you can extend the period by another 45 days in exceptional circumstances (e.g., when consumer requests are complex or numerous), as long as you notify consumers about the extension.

How Businesses Can Comply With Colorado Regulations

To remain compliant with the Colorado Privacy Act, ensure you do the following:

1. Review and Revise Your Privacy Policy

If your company is within the scope of the CPA, you must revise your existing data practices and update your privacy policy to be in full compliance with the law.

Your privacy policy must address (in detail) your data processing activities, the privacy rights of consumers, and the process by which consumers can exercise these rights.

2. Carry out Data Processing Assessments

Data processing assessments enable organizations to review how they sell, use, and process personal data.

If you own a business website, the CPA requires you to periodically conduct data protection assessments before implementing processing operations that could pose a greater risk to consumers.

3. Implement a Consent Mechanism to Obtain Sensitive Data

Similar to other U.S. privacy legislation, the CPA is more sensitive to data and, therefore, requires explicit consent from consumers before trying to process their sensitive data.

Under the CPA, consent must be given freely through a clear and affirmative action.

As your business prepares for the CPA, the WPLP Compliance Platform can offer you plugins to ease your compliance process. Plugins like WP Legal Pages and WP Cookie Consent can help you comply with the law.

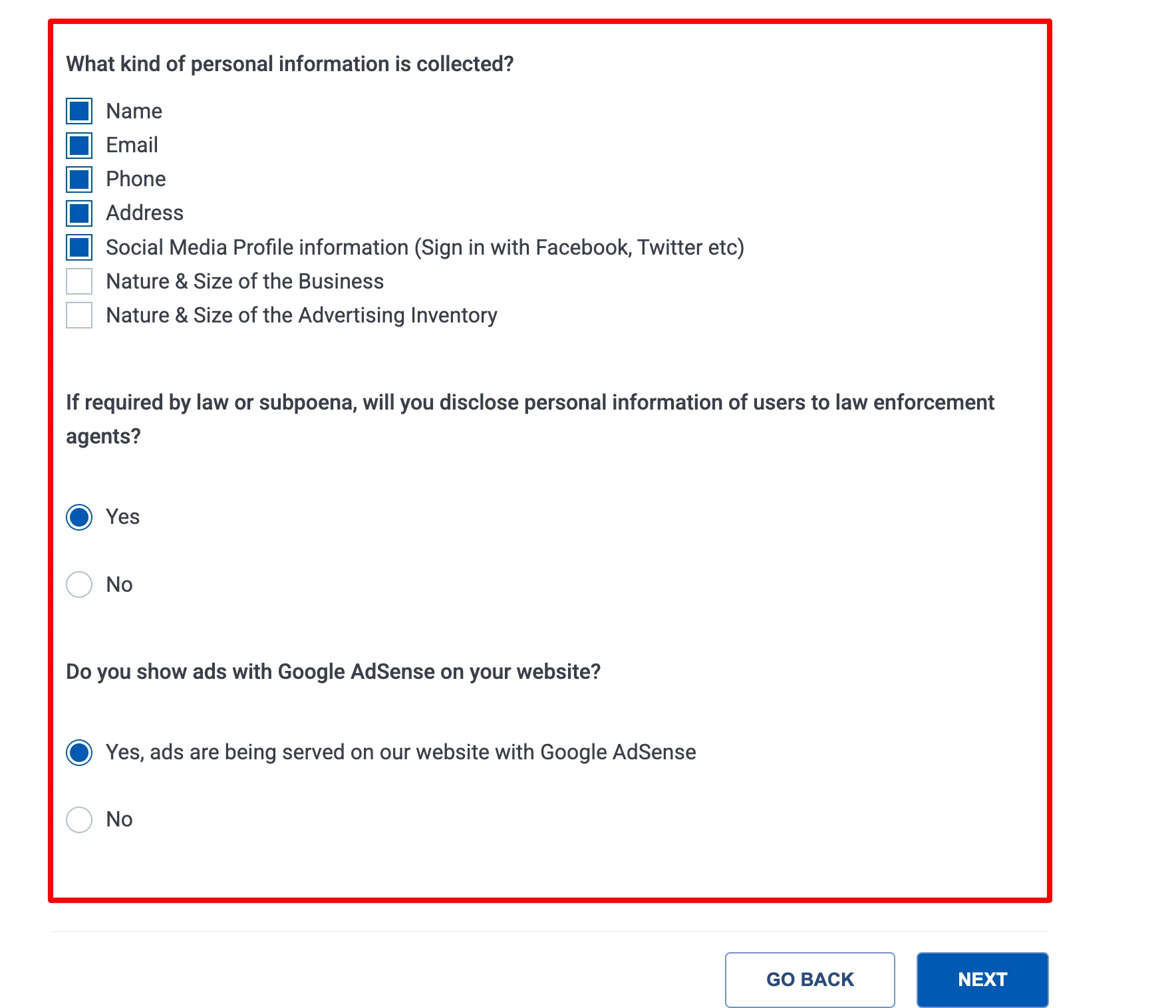

WP Legal Pages helps you generate privacy policies by answering simple business-related questions.Then, it generates a compliant policy based on your responses, which can be uploaded to your website in just seconds.

See what it looks like below.

WP Cookie Consent helps you meet opt-out requirements set by laws like the CPA

See a sample of it below.

Colorado Privacy Act Penalties and Fines for Non-Compliance

The CPA does not include a private right of action. In comparison to other state laws, the CPA can be enforced by the Colorado attorney general and district attorneys.

Prior to taking any enforcement action, the attorney general or district attorney must send a notice of violation to the controller, who has 60 days to cure or correct the violation.

A CPA violation is considered a deceptive trade practice, but no specific fine or penalty is set in the provisions of the Colorado Privacy Act.

CPA penalties are covered under the Colorado Consumer Protection Act and range from $2,000 to $20,000 per offense. As stated in the Consumer Protection Act, violating the CPA can result in criminal charges,

FAQ

The Colorado Privacy Act, or CPA, is a federal law that protects consumers’ personal data online. It also outlines how companies should manage the personal information of Colorado residents.

The Colorado Privacy Act applies to any data controller who conducts business in Colorado or has control over 100,000 consumers’ personal data during a calendar year.

The violation of the Colorado Privacy Act is considered a deceptive trade practice. As the CPA penalties fall under the Colorado Consumer Protection Act, fines can range from $2,000 to $20,000 per violation.

To comply with the Colorado Privacy Act, businesses should have a privacy policy and a cookie consent banner on their website. We recommend using the WPLP Compliance Platform.

Conclusion

The Colorado Privacy Act is a law that ensures individuals’ personal data remains secure and that companies handle consumers’ data responsibly.

If your business already complies with California or Virginia privacy laws, you may not need to do much to be considered compliant under the CPA.

Whether you’re a small startup or a large enterprise, WP Legal Pages Compliance Platform can help you comply with privacy legislation, such as the Colorado Privacy Act and other laws worldwide.

If you like this article, you might also like reading:

- Nebraska Data Privacy Act: A Complete Guide to Compliance

- New Hampshire Data Privacy Act (NHPA) – A Compliance Guide

- Delaware Personal Data Privacy Act – Easy Compliance Guide

Are you looking to stay compliant with data privacy regulations? Grab the WP Legal Pages Compliance Platform now!