What Is the Gramm Leach Bliley Act (GLBA)?

Summary

Financial institutions must follow strict privacy and security rules. Our article covers key components like the Safeguards Rule, Financial Privacy Rule, and Pretexting Provisions.

Learn how to create a GLBA-compliant privacy policy and implement security safeguards.

Curious to know about the Gramm-Leach-Bliley Act (GLBA) and its significance in the financial industry?

The Gramm-Leach-Bliley Act, often abbreviated as GLBA, is a crucial piece of legislation that has profoundly impacted how financial institutions handle customer data and ensure consumer privacy.

Let’s delve into the nuances of the GLBA and explore its implications in today’s digital age.

- What is the Gramm Leach Bliley Act of 1999 (GLBA)?

- Common Terms and Definitions Used Under GLBA Act

- What Are The Key Rules of the GLBA Law

- Who Must Comply With the Gramm-Leach-Bliley Act (GLBA)?

- How Gramm Leach Bliley Act Can Impact Your Business

- How to Prepare for GLBA Compliance

- What are the Penalties for GLBA Non-Compliance?

- FAQ

- Conclusion

What is the Gramm Leach Bliley Act of 1999 (GLBA)?

The Financial Modernization Act of 1999 is another name for the Gramm Leach Bliley Act, GLB Act, or GLBA. Federal law in the United States requires financial institutions to explain how they share and safeguard their clients’ private information.

Financial institutions must inform customers about their right to opt-out if they do not want their personal data shared with third parties.

They must also explain how they share sensitive customer data and put specific safeguards in place to protect customers’ private information per a written information security plan to comply with GLBA regulations.

The FTC’s Financial Privacy Rule, established under the GLBA to promote the implementation of GLBA standards, contains additional privacy and security requirements in addition to the GLBA’s main data protection implications described in its Safeguards Rule.

The Federal Trade Commission, state insurance supervision organizations, federal banking agencies, and other federal regulatory bodies all enforce the GLBA.

Common Terms and Definitions Used Under GLBA Act

Here are some of the most essential terms and definitions used under GLBA Act

- Financial Institution: According to section 4(k) of the Bank Holding Company Act of 1956, a financial institution is any organization or business that engages in financial operations or those that are incidental to such activities. Examples of financial institutions include banks, insurance underwriters and agents, travel agencies, mortgage bankers, securities brokers, and dealers.

- Nonpublic personal information: Any confidential information a client provides to a financial institution in exchange for receiving a

- Financial product or service from the institution;

- Information derived from a financial product or service transaction between the client and the financial institution;

- Data that a financial institution obtains about a client while providing a financial product or service

- Nonaffiliated third party: A nonaffiliated third party is any individual who is not an affiliate of a financial institution or works jointly for a financial institution and a business that is not an affiliate of the institution.

- Affiliate: An affiliate is any business that either shares control over the financial institution or is controlled by it.

- Consumer: Any person who purchases or has already purchased a financial product or service with the primary intention of using it for personal, family, or home needs or that person’s legal representative.

- Customer: A customer relationship refers to an ongoing association in which a financial institution provides one or more financial products or services to be used primarily for personal, family, or business purposes. This applies to a financial institution’s clients with such a relationship.

What Are The Key Rules of the GLBA Law

The Gramm Leach Bliley Act has three key rules. These rules seem to have been created to help people understand their legal responsibilities.

The purpose of these three projects is to provide information and guidance to organizations covered by the law about

- Types of data to be protected

- Specific measures expected from the bill

- Prevention and reduction of unauthorized access opportunities.

Here are brief descriptions of each of those 3 components in the GLBA:

Financial Privacy Regulation

A business must abide by the GLBA’s privacy regulation if it is a “financial institution” or if it obtains “nonpublic personal information (NPI)” about its customers from one of these entities.

This law applies to transactional data (bank account numbers, card numbers) and most personal information (name, date of birth, Social Security number, etc.).

It also includes any private information you might get from a transaction (like a credit report). The FTC has a page that covers every facet of the privacy rule here.

Safeguards Rule

This rule guarantees that persons covered by the GLBA have particular tools to safeguard personal data.

GLBA compliance requires “the administrative, technical, or physical safeguards you use to access, collect, distribute, process, protect, store, use, transmit, dispose of, or otherwise handle customer information,” as stated in the rule’s actual language.

The text also includes an outline of several of these strategies.

Notable prerequisites consist of:

- Employee education

- Appropriate software

- Examining and keeping an eye on vulnerabilities

Pretexting Provisions

Organizations covered by the GLBA must take precautions against unauthorized access and safeguard nonpublic personal information (NPI).

Many dishonest con artists attempt to obtain personal information over the phone, email, or even in person.

Pretexting laws are designed to lessen this data loss and safeguard more customers.

Who Must Comply With the Gramm-Leach-Bliley Act (GLBA)?

Every American financial institution is required to abide by the Gramm-Leach-Bliley Act, which covers the following:

- Advice on investments or finances

- Insurance Agency

- financial services

- Service providers: ATM operators

- Debt collectors

- Companies that rent cars

The laws also apply to foreign organizations that provide financial services to citizens of the United States.

How Gramm Leach Bliley Act Can Impact Your Business

The following are some ways that the Gramm Leach Bliley Act (GLBA) may affect your company:

- Compliance Requirements: To protect sensitive customer information, businesses covered by the GLBA must create and maintain a thorough Written Information Security Plan (WISP). Failure to meet these requirements may result in fines and penalties.

- Data Security Measures: Under the GLBA, firms must implement administrative, technical, and physical measures to protect consumer data. These measures may include investments in encryption technology, access controls, and cybersecurity.

- Customer Credibility and Trust: Businesses can establish credibility and boost trust by exhibiting GLBA compliance and proactively safeguarding customer information. Conversely, non-compliance or data breaches can undermine customer confidence and harm a company’s brand.

- Legal and Financial Repercussions: Failure to comply with the GLBA may result in serious legal repercussions, such as regulatory bodies fining you. Firms may also suffer financial losses due to legal bills, penalties, and possible litigation in a data breach.

- Operational Implications: To comply with GLBA regulations, businesses may need to set aside funds, invest in cybersecurity infrastructure, and provide staff training on data security procedures. This might affect operational effectiveness and require modifications to corporate procedures.

- Competitive Advantage: You can differentiate yourself from rivals by making GLBA compliance a central tenet of your company strategy. Customers who value the safety of their sensitive information may be drawn to businesses that exhibit a commitment to data security and privacy.

To ensure compliance, safeguard sensitive data, and uphold customer trust, you must comprehend how GLBA may affect your company. In an increasingly data-driven environment, proactive GLBA compliance can help reduce risks and set up your company for long-term success.

How to Prepare for GLBA Compliance

Preparing for Gramm Leach Bliley Act compliance is crucial for financial institutions and businesses that handle sensitive customer information.

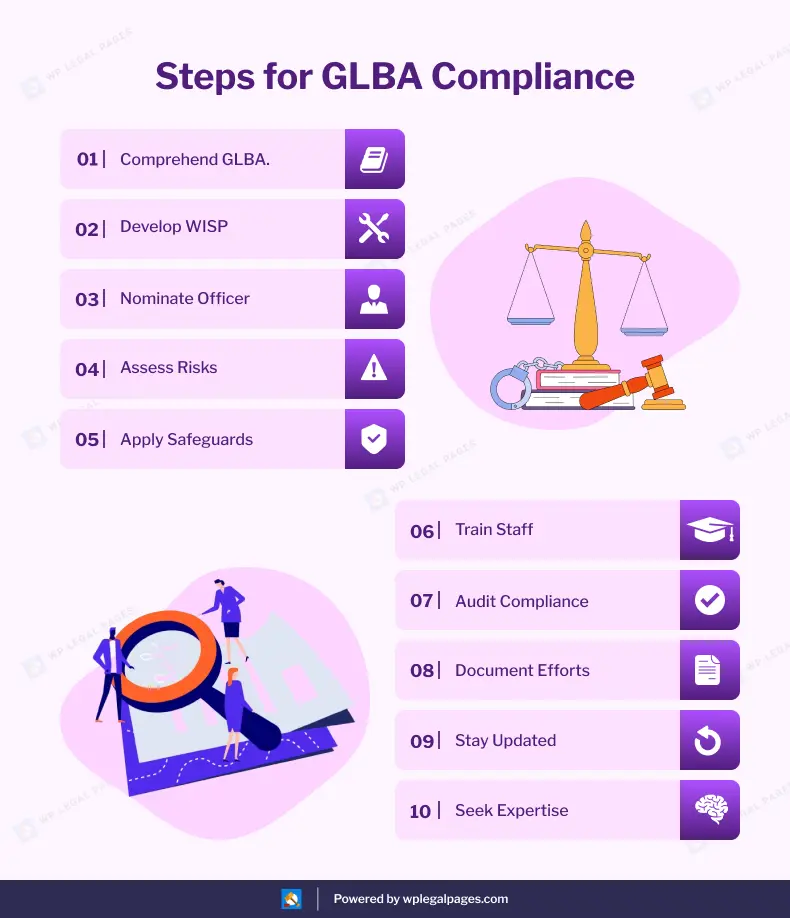

Here are some steps to help you prepare for GLBA compliance:

1. Understand GLBA requirements.

2. Create a Written Information Security Plan (WISP).

3. Appoint a Security Officer.

4. Conduct regular risk assessments.

5. Implement physical, technical, and administrative safeguards.

6. Provide employee training on security measures.

7. Monitor compliance and conduct audits.

8. Maintain detailed documentation of compliance efforts.

9. Stay informed about GLBA regulations.

10. Consider seeking expert assistance for compliance.

Following these steps will help your organization comply with GLBA regulations, protect customer information, and avoid potential penalties for non-compliance.

We recommend using WP Legal Pages plugins to create a privacy policy for your website. This will help you comply with GLBA regulations. These plugins can quickly generate legal pages and are kept up to date with the latest data privacy laws.

What are the Penalties for GLBA Non-Compliance?

Compliance with the Gramm Leach Bliley Act (GLBA Law) mandates that financial institutions safeguard their customers’ non-public personal information (NPI).

The penalties for Gramm Leach Bliley Act non-compliance can be significant. GLBA privacy rules are enforced by state attorneys general and the Federal Trade Commission (FTC). Each violation penalty can vary from $100 to $100,000 per day.

If found guilty of willful or careless disregard for GLBA regulations, people and organizations may also be subject to criminal prosecution, fines, and possibly jail time. Comprehensive risk assessments, policies, and ongoing staff training are necessary for effective compliance.

FAQ

The GLBA law is a federal law in the US that protects, safeguards and regulates the sharing of customers’ personal information.

The GLBA privacy rule applies to all financial institutions that offer credit, investments, mortgages, products, or services, including banks and others.

Financial Institutions can have a privacy policy on their website to comply with GLBA law. To Create a privacy policy on the website, you can use a free Privacy policy generator known as WP Legal Pages.

Conclusion

If your business is subject to the Gramm Leach Bliley Act, you must give your customers access to a privacy policy that satisfies legal requirements and gives them discretion over how their data is shared.

You must also develop and implement a documented plan to guarantee the security and safety of the data you gather and avoid data breaches and illegal access.

We recommend using the WP Legal Pages plugin to comply with the Gramm Leach Bliley Act. The plugin will help you draft a GLBA-compliant privacy policy for your website.

If you found this article informative, you can explore our other published articles for additional insights and knowledge:

- What is the California Consumer Privacy Act (CCPA)

- Health Insurance Portability and Accountability Act (HIPAA)

- General Data Protection Regulation (GDPR)

Grab the WP Legal Pages plugin to create the best legal pages for your website.